Find out as much as you can about forex before investing in it. A demo account is the ideal way to practice this in a risk-free environment. The following tips will help to optimize the learning process for you.

Pay close attention to the financial news, especially in countries where you have purchased currency. Current events can have both negative and positive effects on currency rates. Setting up some kind of alert, whether it is email or text, helps to capitalize on news items.

Do not trade with your emotions. If you trade based on greed, anger, or panic, you can wind up in a lot of trouble. While some excitement or anxiety is inevitable, you always want to trade with a sensible goal in mind.

You should remember that the forex market patterns are clear, but it is your job to see which one is more dominant. When the market is in an upswing, it is easy to sell signals. Make your trades based on trends.

Making use of Forex robots is not recommended whatsoever. This may help the sellers, but it will not help the buyers. Make decisions on where to place your money and what you want to trade before actually doing so.

Careful use of margin is essential if you want to protect your profits. Margin can boost your profits quite significantly. But, if you trade recklessly with it you are bound to end up in an unfavorable position. The use of margin should be reserved for only those times when you believe your position is very strong and risks are minimal.

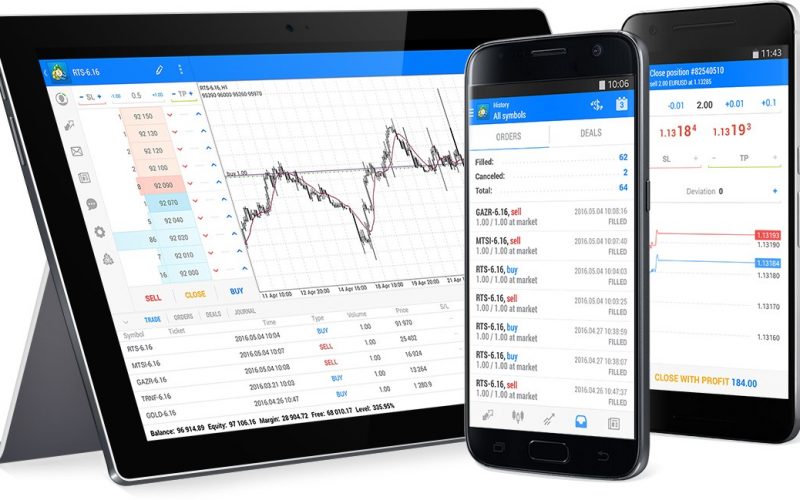

You can get analysis of the Forex market every day or every four hours. Modern technology and communication devices have made it easy to track and chart Forex down to every quarter hour interval. These short term charts can vary so much that it is hard to see any trends. Stay focused on longer cycles in order to avoid senseless stress and fake excitement.

If you are working with forex, you need to ensure you have a trustworthy broker. Try to choose a broker known for good business results and who has been in business for at least five years.

Do not attempt to get even if you lose a trade, and do not get greedy. When doing any kind of trading it’s important to maintain control of your emotions. Allowing your emotions to take over leads to bad decision and can negatively affect your bottom line.

It is a common myth that your stop-loss points are visible to the rest of the market, leading currencies to drop just below the majority of those points and then come back up. There is no truth to this, and it is foolish to trade without a stop-loss marker.

Forex Trading

Accurately placing stop losses for Forex trading requires practice. You can’t just come up with a proper formula for trading. Forex traders need to strike the correct balance between market analysis and pure instincts. You will need to gain much experience before Forex trading becomes familiar to you.

In order to find success with Forex trading, it may be a good idea to start out as a small trader. Spend a year dealing only with a mini account. This is the simplest way to know a good trade from a bad one.

Knowing when to buy and when to sell can be confusing, so watch for cues in the market to help you decide. Software can be configured so you’re alerted once a particular rate is reached. If you set your ideal points for getting in and out well in advance, you can maximize the benefit of the ideal rate by acting immediately.

Use stop loss orders to limit your losing trades. Too many traders hold onto a losing positions, hoping that the market trend will reverse.

Test your real Forex trading skills through a mini account first. Using this is excellent practice for trading while limiting the amount of losses you will suffer. You may feel penned in because you can’t make large, lucrative trades, but spending a year looking at your trading gains and losses is an invaluable experience.

You can discover forex related news no matter what time it is. It is possible to find information on sites like Twitter or on television news. There is nowhere it can’t be found. This is because everybody wants to be in the know at all times.

You will need good logical reasoning skills in order to extract useful information from data and charts. Make sure you gather data from different sources, as this is an important part of Forex trading.

Commit yourself to personally watching your trading activities. You should be hesitant about relying on a piece of software to track your activities for you. While Forex is made of numbers, it does rely on human intelligence and drive to make wise decisions to be successful with it.

have a notebook on your person at all times. If you encounter interesting market information while you are out, you can write it down for future use. A notebook can help you keep a record of how things are going. Make sure to frequently review your notes to help gauge their usefulness.

Once you have immersed yourself in forex knowledge and have amassed a good amount of trading experience, you will find that you have reached a point where you can make profits fairly easily. The process of educating yourself on forex is an unending one; keep learning so that you can stay abreast of changes and new developments. Continue to go through forex websites, and stay on top of new tips and advice in order to stay ahead of the game in forex trading.